Homeowners Insurance in and around Portland

A good neighbor helps you insure your home with State Farm.

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

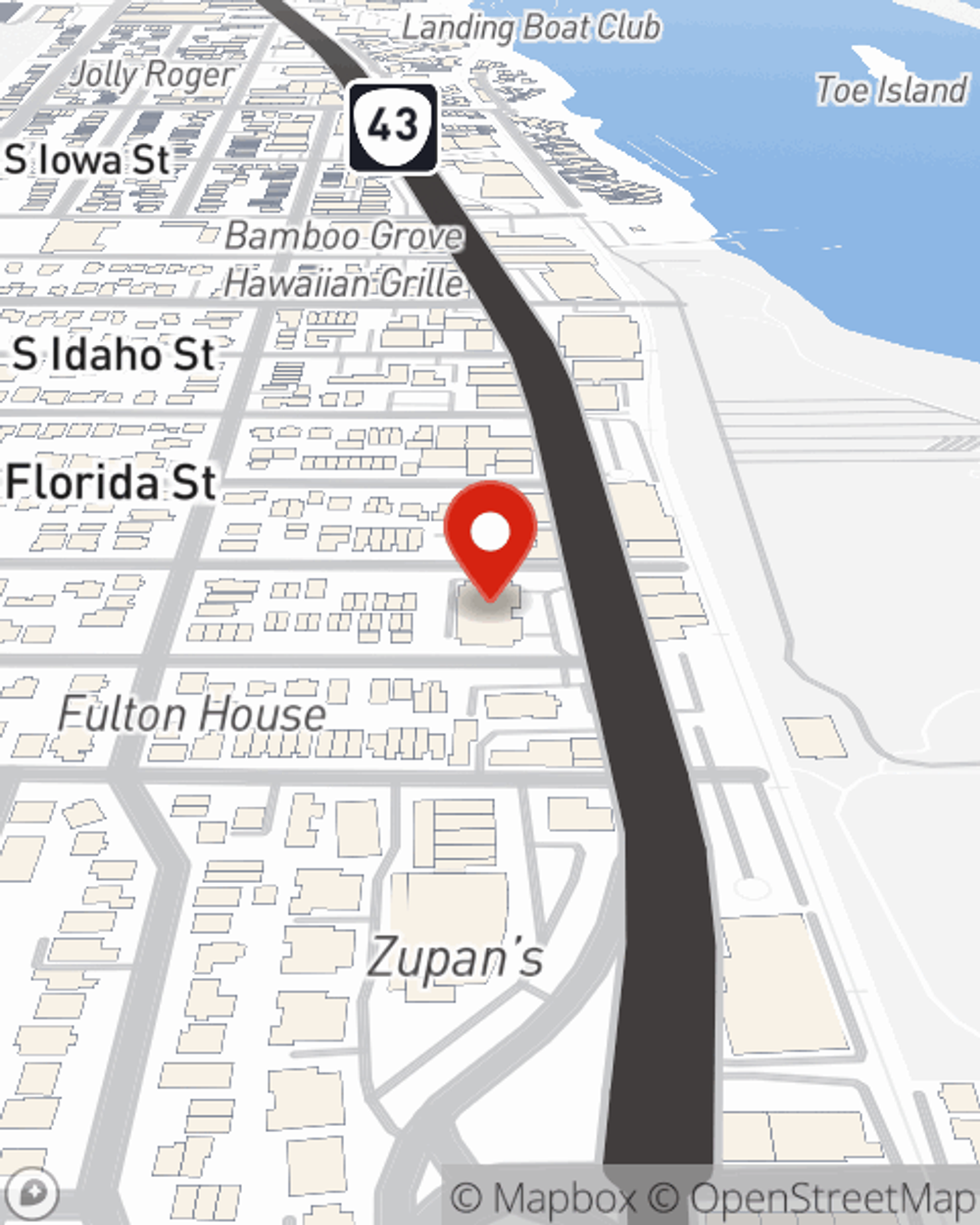

- John's Landing, OR

- Lake Oswego

- Sellwood

- Burlingame

- Hillsboro

- Beaverton

- Happy Valley

- Vancouver, WA

- Clackamas County

- Washington County

- Multnomah County

- Milwaukie

- Woodstock

- Gresham

- Northwest

- Banks

- Laurelhurst

- Sunnyside

- Bridlemile

- Eastmoreland

- Salem

- West Linn

- Eugene

- Oregon City

What's More Important Than A Secure Home?

Everyone knows having excellent home insurance is essential in case of a blizzard, hailstorm or ice storm. But homeowners insurance is about more than covering natural disaster damage. Another helpful thing about home insurance is its ability to protect you in certain legal situations. If someone falls at your residence, you could be held responsible for their lost wages or the cost of their recovery. With the right home coverage, your insurance may cover those costs.

A good neighbor helps you insure your home with State Farm.

Apply for homeowners insurance with State Farm

Agent Teague Bechtel, At Your Service

Homeowners coverage like this is what sets State Farm apart from the rest. Agent Teague Bechtel can be there whenever you have problems at home, to get you back in your routine. State Farm is there for you.

There's nothing better than a clean house and protection with State Farm that is commited and reliable. Make sure your home is insured by contacting Teague Bechtel today!

Have More Questions About Homeowners Insurance?

Call Teague at (503) 914-1206 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Flooded basement? How to deal with common causes

Flooded basement? How to deal with common causes

Wet basement problems can cost you thousands of dollars. Here are steps to help identify the source of the water and ways to minimize your risk.

Radon gas in homes: What to know

Radon gas in homes: What to know

Radon gas is odorless, colorless and the second leading cause of lung cancer. These are some common methods for assessing, preventing or removing it.

Teague Bechtel

State Farm® Insurance AgentSimple Insights®

Flooded basement? How to deal with common causes

Flooded basement? How to deal with common causes

Wet basement problems can cost you thousands of dollars. Here are steps to help identify the source of the water and ways to minimize your risk.

Radon gas in homes: What to know

Radon gas in homes: What to know

Radon gas is odorless, colorless and the second leading cause of lung cancer. These are some common methods for assessing, preventing or removing it.